Index Funds Out-performance Continues

Low cost index funds outperform market averages.

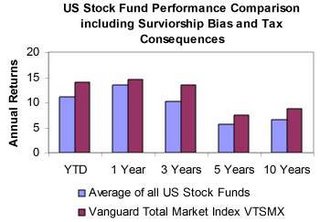

The chart below compares the returns of all US stock funds and the Vanguard Total Market fund as of 11/17/06.

Other things to consider:

Survivorship Bias

The 3, 5 and 10 year annual returns for "all" mutual funds are actually overstated. Each year between 3% and 15% of funds go out of existence (end and return money to investors or merge into another fund). These are typically the lower performing funds (otherwise why would they go out of business) that if included would bring the average down and make the relative performance of the index funds even better.

Tax Consequences

Most of the funds in the average are actively managed with higher turnover than index funds. Turnover causes short and long term capital gains and their associated tax consequences.

The chart below conservatively estimates the impact of survivorship bias and taxes and compares the returns.

The results are similar when comparing all of the international stock funds with the Vanguard Interantional stock fund index (VGTSX) below: